CALL US: (914) 946-2889 • 245 Main Street, Suite 450, White Plains, NY 10601

BLOG

OUR BLOG

By Frank Malara

•

21 Oct, 2020

New York State Governor Andrew M. Cuomo extended the State’s moratorium on COVID-related commercial evictions and foreclosures through January 1, 2021. The Executive Order extends protections already in place in recognition of the financial toll the COVID-19 pandemic has taken on businesses, including restaurants. The extension gives commercial tenants and mortgagors additional time to catch...

The post News Bulletin: Commercial Eviction Moratorium Extended appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

26 Sep, 2020

In part 1 of this two-part series, we covered the basics of business interruption insurance, also known as business income insurance. This article will focus on the intersection of business interruption insurance and COVID-19. Does business interruption insurance cover losses from COVID-19? Many insurance companies are denying business interruption insurance claims related to COVID-19. Even...

The post Business Interruption Insurance, Part 2 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

18 Sep, 2020

Welcome to the third of a three-part series on credit scores. This article looks at how you can monitor your credit score. Part 1 focuses on credit score rankings. Part 2 delves into what influences credit scores. What is a credit score? Your credit score is a numerical rating of your credit worthiness. Basically, the...

The post Demystifying your credit score, part 3 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

13 Sep, 2020

Business interruption insurance is a standard tool in a business’s risk management toolbox. But will your policy cover business income loss due to the global COVID-19 pandemic? This is the first of two articles on business interruption insurance. This article focuses on the basics, and the follow-up is specific to COVID-19. First, what is business...

The post Business Interruption Insurance, Part 1 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

07 Sep, 2020

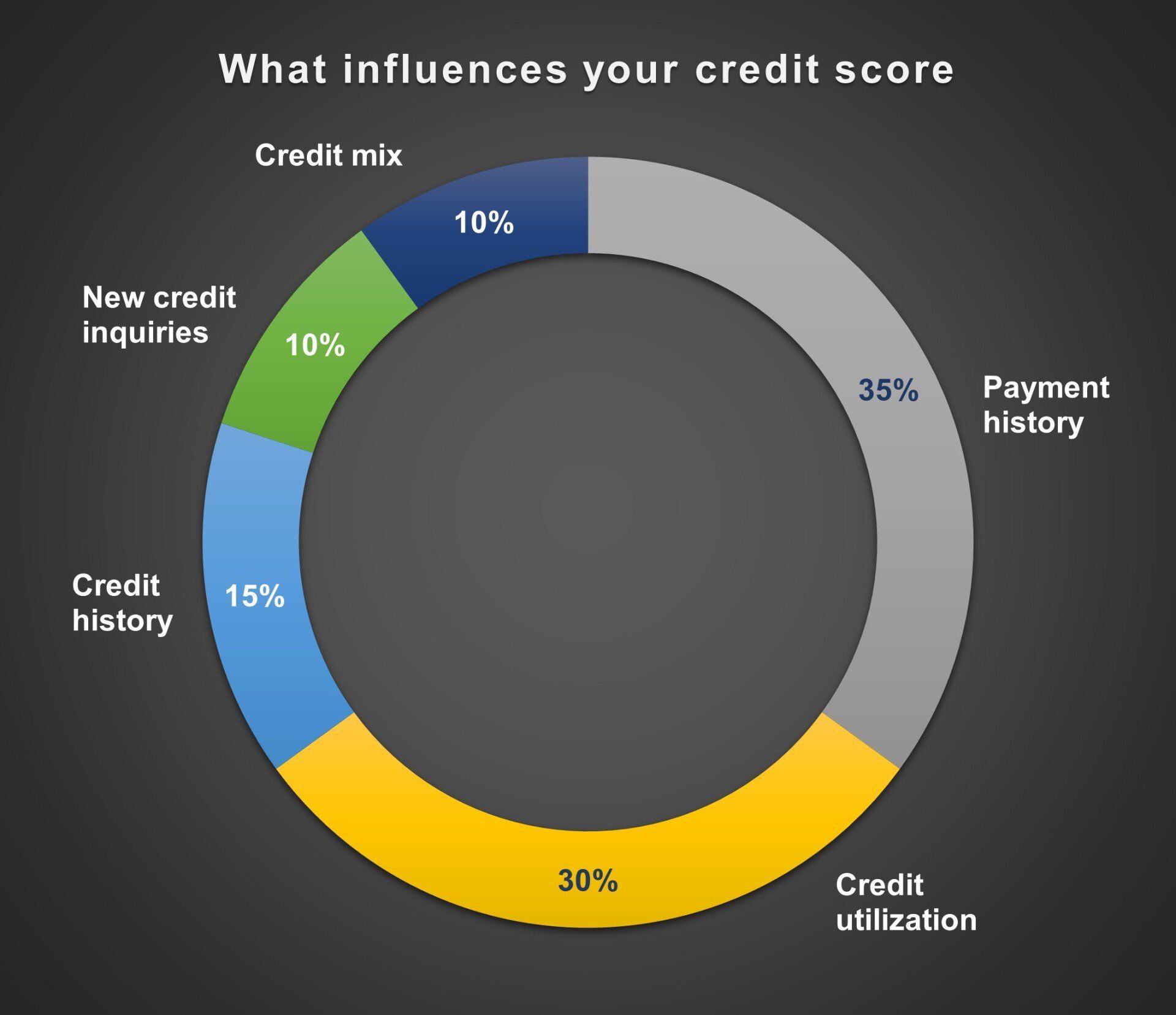

In the second part of this series, we look at what influences your credit score. Part 1 of this series goes over credit score ranges. Part 3 looks at how you can monitor your credit score. What is a credit score? To refresh your memory, your credit score is a numerical rating of your credit...

The post Demystifying your credit score, part 2 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

26 Aug, 2020

No one wants to lose their home. Whether a job loss, medical bills, or a divorce puts you in a precarious financial position, there are ways to mitigate a bad financial situation and keep you in your home. What exactly is foreclosure? Foreclosure is a legal process where a lender recovers the balance of a...

The post Having trouble paying your mortgage? appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

20 Aug, 2020

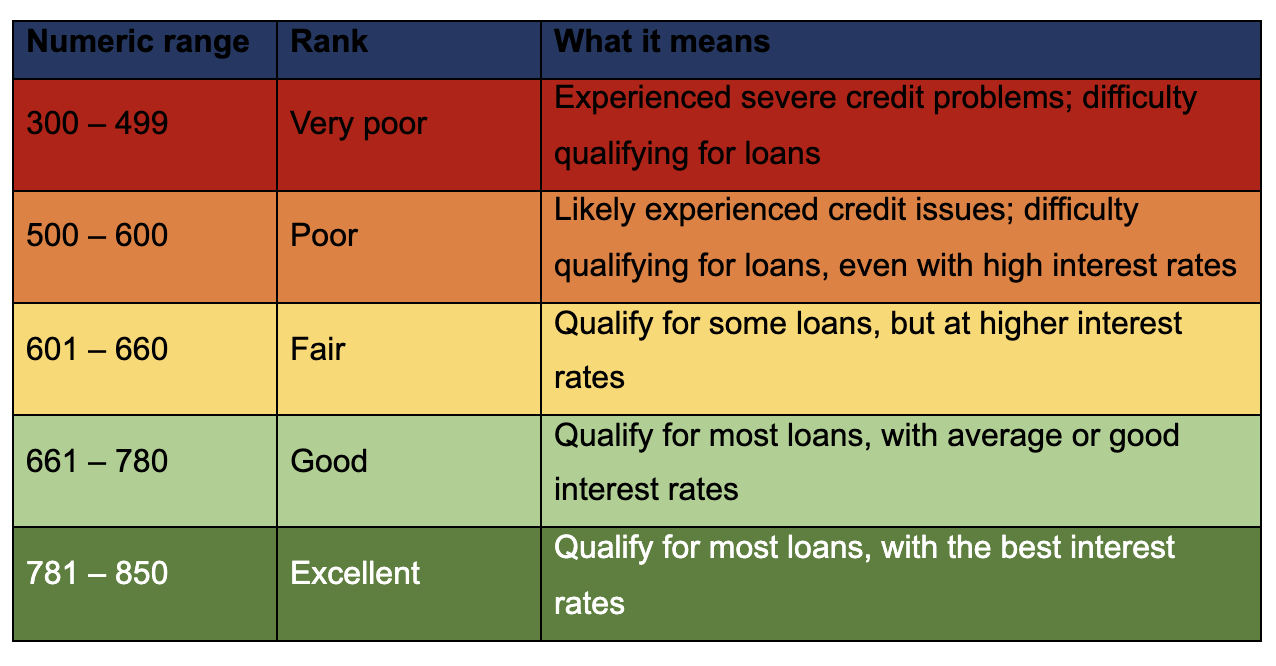

Welcome to the first of a three-part series on credit scores. This article focuses on credit score rankings. Part 2 delves into what influences credit scores. And Part 3 looks at how you can monitor your credit score. What is a credit score? Your credit score is a numerical rating of your credit worthiness, or...

The post Demystifying your credit score, part 1 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

12 Aug, 2020

Bankruptcy means a fresh financial start for your family but discharging your debt is only the first step to repairing and building good credit. Create and stick to a monthly budget. In your post-bankruptcy life it is critical to live within your means. Otherwise, you may backslide into debt. Creating a monthly budget will help...

The post Recovering from Bankruptcy appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

By Frank Malara

•

11 Aug, 2020

Critical Executive Order on eviction comes just in time. Governor Cuomo announced an extension of a moratorium on evictions during the coronavirus pandemic. The moratorium was due to expire at midnight, but is now extended to September 4, 2020. The Governor’s Executive Order is covered under the Tenant Safe Harbor Act. The Act provides protections...

The post News Bulletin: Eviction Moratorium Extended appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.

Office Location

245 Main Street

Suite 450

White Plains, NY 10601

Office Location

245 Main Street

Suite 450

White Plains, NY 10601

Services

© 2024

PM Law LLP | All Rights Reserved | Privacy Policy & Accessibility | Powered by PS Digital

This website is for informational purposes only and does not provide legal advice. Please do not act or refrain from acting based on anything you read on this site. Using this site or communicating with PM Law LLP through this site does not form an attorney/client relationship. This site is legal advertising.

Required Disclaimer: Attorney Advertising. We are a federally designated Debt Relief Agency under the United States Bankruptcy Laws.