In the second part of this series, we look at what influences your credit score. Part 1 of this series goes over credit score ranges. Part 3 looks at how you can monitor your credit score.

What is a credit score?

To refresh your memory, your credit score is a numerical rating of your credit worthiness. Basically, the higher your score, the more favorable creditors are likely to view your applications for new credit cards and mortgages and other loans.

How is my credit score calculated?

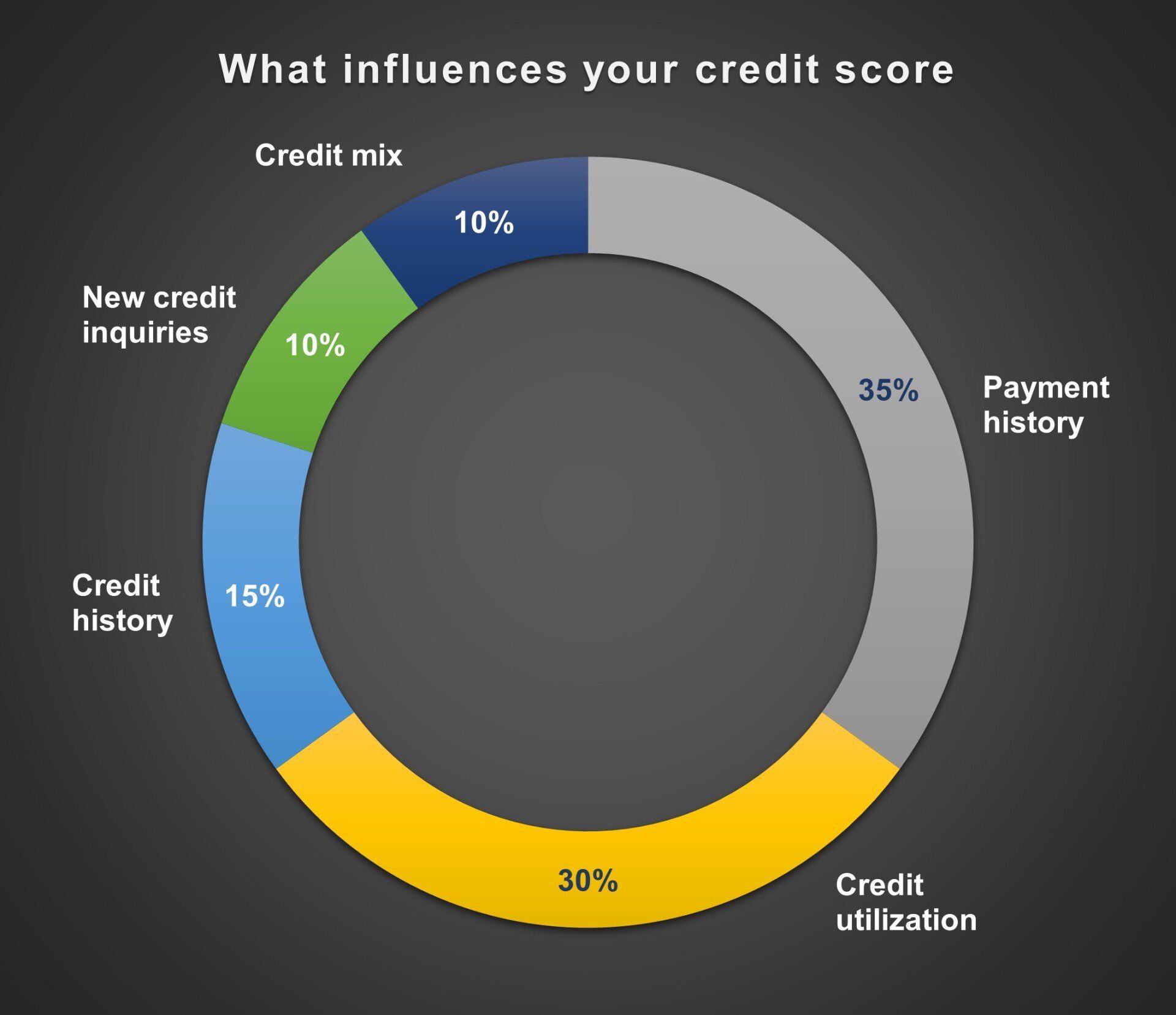

There are five factors that go into your credit score.

1. Payment history (35%). Payment of your past and current bills and loans is the largest indicator of your reliability to repay new ones. Lenders are required to report past due payments, so paying your bills in full and on time are critical to maintaining your credit rating.

2. Credit utilization (30%). This is a measure of how much credit you’re using to how much you have available. So, if you have a total of $10,000 of credit available on all of your credit cards and you’ve used $5,000 of it, then your credit utilization is 50%. A good rule of thumb is to keep your utilization below 30%.

3. Credit history (15%). This is the average length of time you’ve had credit open. If you’re currently 30 years old, you initiated a student loan when you were 18, and opened a credit card when you were 20, you have 11 years of credit history (the math: ((30 years old – 18 years old = 12 years) + (30 years old – 20 years old = 10 years)) / 2 forms of credit = 11).

4. New credit inquiries (10%). Every time an application for credit is made in your name your credit score goes down. Credit inquiries can occur when you apply for a mortgage, get a new cell phone provider, or open a new credit card account. However, “soft” inquiries, like credit reports as part of a background check should not impact this part of your credit score.

5. Credit mix (10%). This looks at the types of credit you have. Credit cards are considered “open-ended” while car or student loans have a definitive end.

The post Demystifying your credit score, part 2 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.