Welcome to the first of a three-part series on credit scores. This article focuses on credit score rankings. Part 2 delves into what influences credit scores. And Part 3 looks at how you can monitor your credit score.

What is a credit score?

Your credit score is a numerical rating of your credit worthiness, or from a lender’s perspective, what their risk is in extending credit to you. Basically, the higher your score, the more favorable creditors are likely to view your applications for new credit cards and mortgages and other loans.

In the U.S., the most widely used credit score is the FICO score, first developed by the Fair Isaac Corporation. There are 29 different FICO scores, many of them industry-specific; for example, the automotive lending industry utilizes a FICO score tailored to predict that likelihood an individual will repay a car loan.

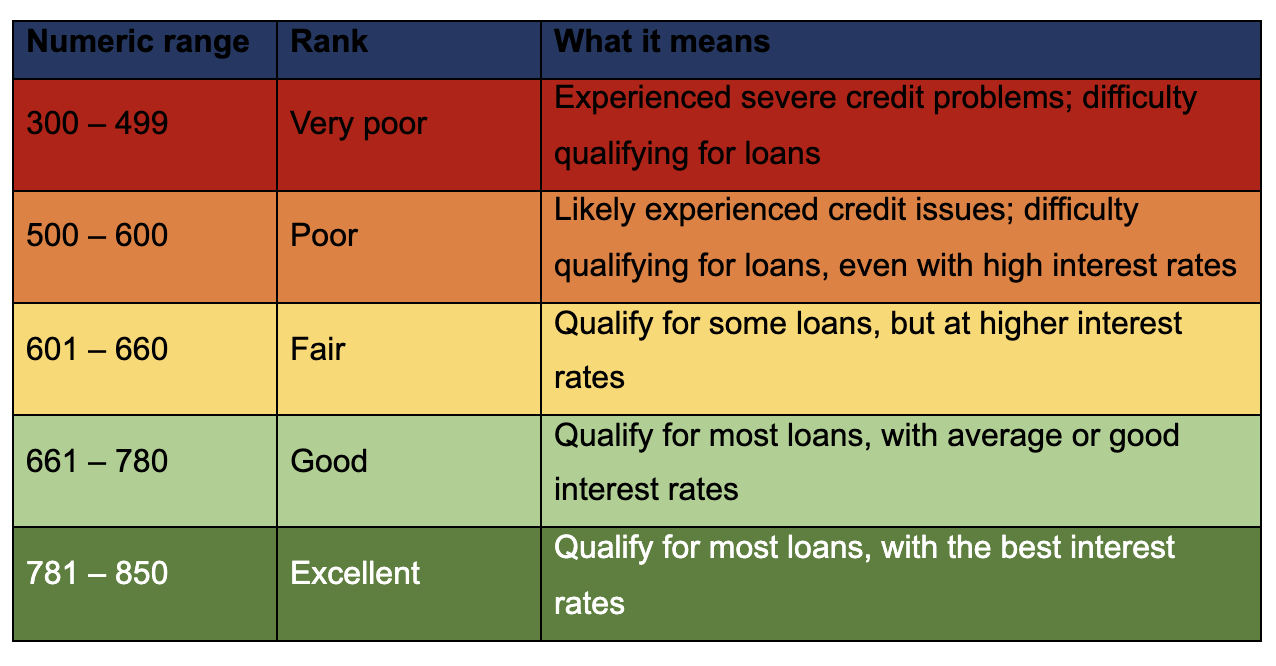

General FICO scores range from 300 to 850. Industry-specific scores are wider, from 250 to 900.

What is considered “good” credit? What about “bad” credit?

Different financial institutions may rank credit using slightly different numeric ranges—sometimes wider ranges, sometimes narrower, or with the ranges shifted a bit. This is a fairly broad representation of numeric credit scores, rankings, and interpretations.

The post Demystifying your credit score, part 1 appeared first on Penachio Malara, LLP - Bankruptcy Lawyers.